Home depreciation calculator

Get Pre-Qualified in Seconds. With proper and accurate calculation of depreciation a company can benefit from the tax advantage.

Straight Line Depreciation Calculator And Definition Retipster

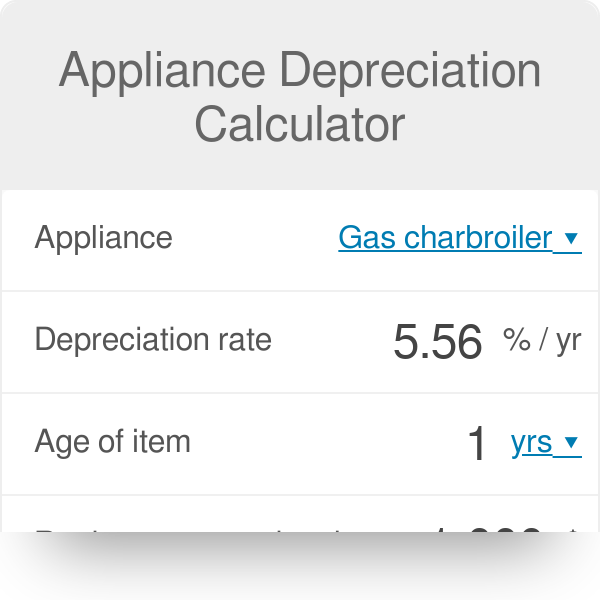

There are many variables which can affect an items life expectancy that should be taken into consideration.

. After writing off Rs. The first step to figuring out the depreciation rate is to add up all the digits in the number seven. Next youll divide each years digit by the sum.

Your home policy has a 2000 deductible. Depreciation in 2nd year 2 x. Seven factors affect property value more.

Desired selling price 302000. The calculator should be used as a general guide only. Factors That Affect Property Value.

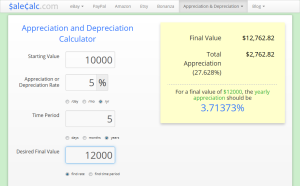

Start by subtracting the initial value of the investment from the final value. There are many variables which can affect an items life expectancy that should be taken into consideration. First one can choose the straight line method of.

This depreciation calculator is for calculating the depreciation schedule of an asset. Our home sale calculator estimates how much money you will make selling your home. Per the IRS you are allowed an annual tax deduction for the wear and tear of property over the course of time known as Depreciation.

The calculator should be used as a general guide only. Ad Best Home Loan Mortgage Rates. The house depreciation rate will depend.

Recoverable depreciation is a feature that is sometimes not worth it when you factor in the deductible. Where A is the value of the home after n years P is the purchase amount R is the annual percentage. A P 1 R100 n.

7 6 5 4 3 2 1 28. It provides a couple different methods of depreciation. Depreciation is an important element in the management of a companys assets.

Compare Offers Apply. ESTIMATED NET PROCEEDS 269830. There are many variables which can affect an items life expectancy that should be taken into consideration.

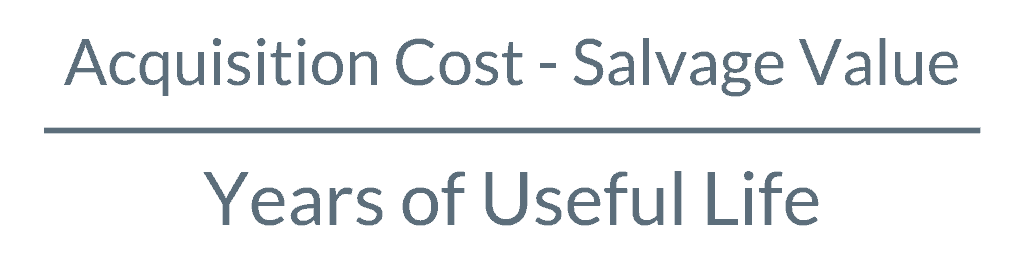

Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. The home appreciation calculator uses the following basic formula. The most common depreciation is called straight-line depreciation taking the same amount of depreciation in each year of the assets useful life.

Depreciation in 1st year 2 x 010 x 400000 80000. 80000 in the 1st year the assets book value will be 320000. Divide the net return by the initial cost of the investment.

To use a home depreciation calculator. You can find the useful life called recovery. In other words the.

This calculation gives you the net return. Also includes a specialized real estate property calculator. Calculate Your Rate in 2 Mins Online.

Unbeatable Mortgage Rates for 2022. As a real estate investor. The calculator should be used as a general guide only.

Depreciation Calculator For Home Office Internal Revenue Code Simplified

How To Use Rental Property Depreciation To Your Advantage

Depreciation Formula Calculate Depreciation Expense

How Is Property Depreciation Calculated Rent Blog

Units Of Production Depreciation Calculator Double Entry Bookkeeping

Free Macrs Depreciation Calculator For Excel

Appreciation Depreciation Calculator Salecalc Com

Straight Line Depreciation Calculator And Definition Retipster

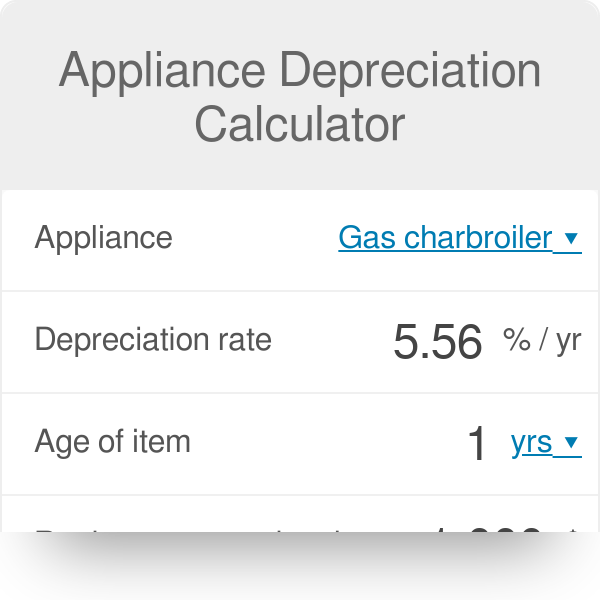

Appliance Depreciation Calculator

Macrs Depreciation Calculator With Formula Nerd Counter

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Depreciation Formula Calculate Depreciation Expense

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Sum Of Years Depreciation Calculator Double Entry Bookkeeping

Download Depreciation Calculator Excel Template Exceldatapro

Macrs Depreciation Calculator Straight Line Double Declining